“A man who buys what is not needed steals from himself and his own future” – Swedish Proverb

For most people, saving money for their future is considered a life goal for when they start earning after college, but for a wise person starting to save while young is the best way to ensure a comfortable life. Undoubtedly the best way to save money as a college student is to buy what you need and not what you want, and making a list of essentials versus luxuries is a good starting point. Continue reading to know the other best ways to save money in college.

Make A List of Essential Expenses and Stick to The List

While everything seems like an essential expense while in college, remember that food, clothing, housing, and health are the only real essentials. While considering food as an expense, consider cooking three nights a week at least or getting food from affordable places. While buying clothes stick to a $10 per garment rule and while choosing houses stick to a place you like, can afford, and doesn’t break the bank.

Invest In Your Health With Medical Insurance

While investing in medical insurance, life insurance, or keeping aside money for emergencies, consider three important factors before buying an insurance policy. The first factor is how much coverage you need vs want. The second factor is, whether you are a high-risk candidate, if yes can you reduce your risk status by reducing smoking, e-cigs, alcohol, and other dangerous habits? The third factor is, how much coverage can you afford every year, with a minimum out-of-pocket expense at the time of using the insurance plan with your HMO provider. While choosing an insurance plan with a higher out-of-pocket expense can reduce your premiums, this will also cause you to spend more whenever you make a claim. Look for policies with a 0-claim payout benefit and also a policy that lets you renew the plan without a steep increase for the first 10 years.

Plan For Your Expenses and Spend Only After You Have Earned The Money

Most college students make the mistake of spending money they are yet to get, which leaves them with little to nothing when the money reaches them. As a general rule, plastic money should be avoided at all costs, especially if you are paying your bills. Credit cards give you buying power but also are a major liability if you cannot eventually make the repayments. Credit cards should be used only in emergencies, for instance, medical, food, and housing expenses. Staying away from peer pressure to visit a pub, or club, celebrate, and spend on shopping is tough but a simple trick to follow is to remember to buy what you need for daily life, not for luxuries and things you may not use regularly.

Search for Entertainment That Doesn’t Cost A Dime

It is easy to get bored, and head to a mall to spend some time, which is perfectly alright until the time window shopping doesn’t lead to buying things on impulse. Instead of malls, look for parks to have homemade cooked picnics at, look for movie theatres and cinemas that offer a discount for students, and search websites like Timeout for free concerts. Additionally, walking or cycling to places is a great way to exercise as well as save some money on transport. Taking the bus, metro line and other public travel systems may seem like a lot of work, but they can save you a pretty penny every month.

Search For Part Time Jobs That Do Not Interfere with Your Studie

The best way to have a bright future is to study as much as you can, however, while studying, an additional part-time job that allows you to work for a couple of hours a day for extra pay can help you save some money aside for a rainy day. One of the ways to save money as a college student is to set aside a fund for yourself with 20% of your weekly income in a digital savings jar and build on this savings with time. Since 20% of your weekly income is not a large amount, it can be easily saved without affecting your needs and lifestyle adversely.

Scholarships That Fund Your Studies and Brighten Your Future

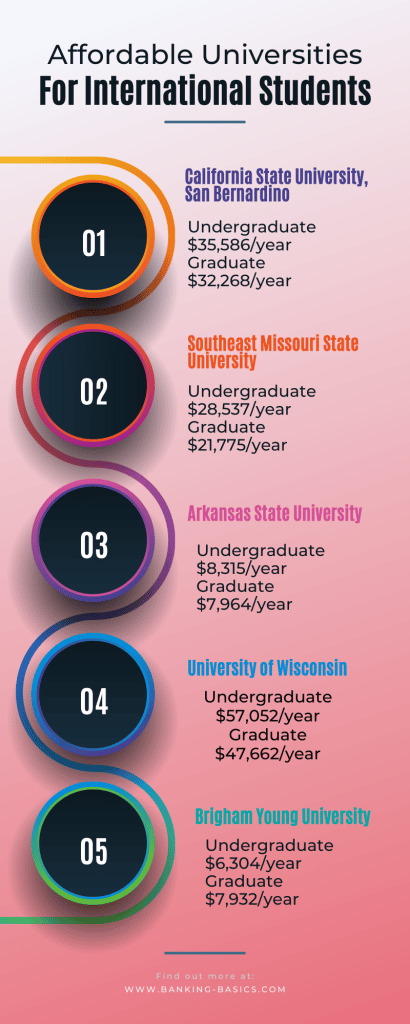

If you are good at a sport and can get a fully paid scholarship playing your favorite sport then consider this option as well. Many universities offer such scholarships and depending on your nationality you can also get a scholarship as an international student.

The top 6 Universities that offer fully paid scholarships for international students for both bachelor’s and master’s degrees are as follows:

- American University Emerging Global Leader Scholarship

- Knight-Hennessy Scholars at Stanford University

- AAUW International Fellowships in USA for Women

- Fully-Funded Rotary Peace Fellowships

- Fulbright Foreign Student Program in the USA

- PEO International Peace Scholarships for Women

Build A Future That is Debt Free, Not Built In Pillars of Debt

The cornerstone of saving money is to have 0f debt by the time you graduate. If you have student loans then looking for part-time jobs that pay you some pocket money is a good way to go. The key is consistency in keeping aside even a little every week so that it builds up by the time you graduate. Buying second-hand goods is a great way to save a bit while acquiring refurbished items. Right from second-hand books to guitars and trinkets, thrift stores have many hidden gems and treasures for you to explore.

Invest Smart, Stay Away From Short Cuts and Quick Fixes

Easy come easy go is an apt statement for certain shortcuts and quick fixes such as gambling, online poker, and online slot machine games. While these techniques might seem like a quick way to earn some extra cash fast, in reality, the house always wins and after a few weeks of online gambling, you will be left with a negative balance instead. If you plan to invest in cryptocurrency or the stock market then do adequate research, there are many blogs, crypto bot websites as well as apps that you can use to get valuable insight before you invest. If you ever consider using a crypto trading bot then make sure to check out Automated Crypto Bots as one of your sources of research before making an investment.

Looking For New Ways to Save Money as a College Student

The tips mentioned here are tried and tested, however, other ways might work for you to save money as a college student. For instance, if you need to shop for groceries, stopping by the store 30 minutes before it closes will give you adequate time to purchase all the items needed, without having any extra time to shop for unnecessary items. The key is to be creative, plan what works for you, and most importantly stick to a budget that you have built for yourself.

If you liked this blog post then share it with your friends who would also like to learn how to save money as a college student. Make sure to follow this blog for more helpful tips about personal finance and saving money from a team of experts.